April 25, 2025 - 22:58

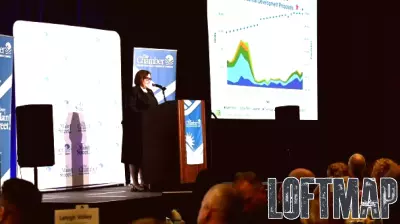

Commercial real estate lending experienced a notable increase of 16% in 2024, reaching a total of $498 billion. This growth was primarily fueled by robust activity in the multifamily sector, which has shown resilience in the face of economic fluctuations. Additionally, strong performance from mortgage banking firms contributed significantly to this upward trend.

Despite this positive momentum, the lending figures remain below the peak levels observed in 2021, indicating that the market is still in a recovery phase. The multifamily segment, in particular, has been a key driver of this growth, attracting investment as demand for rental properties continues to rise.

As lenders and borrowers navigate the evolving landscape of commercial real estate, the increase in lending reflects a cautious optimism among stakeholders. The market dynamics suggest that while challenges remain, the appetite for commercial real estate investment is strengthening, paving the way for potential future growth in the sector.