April 12, 2025 - 11:34

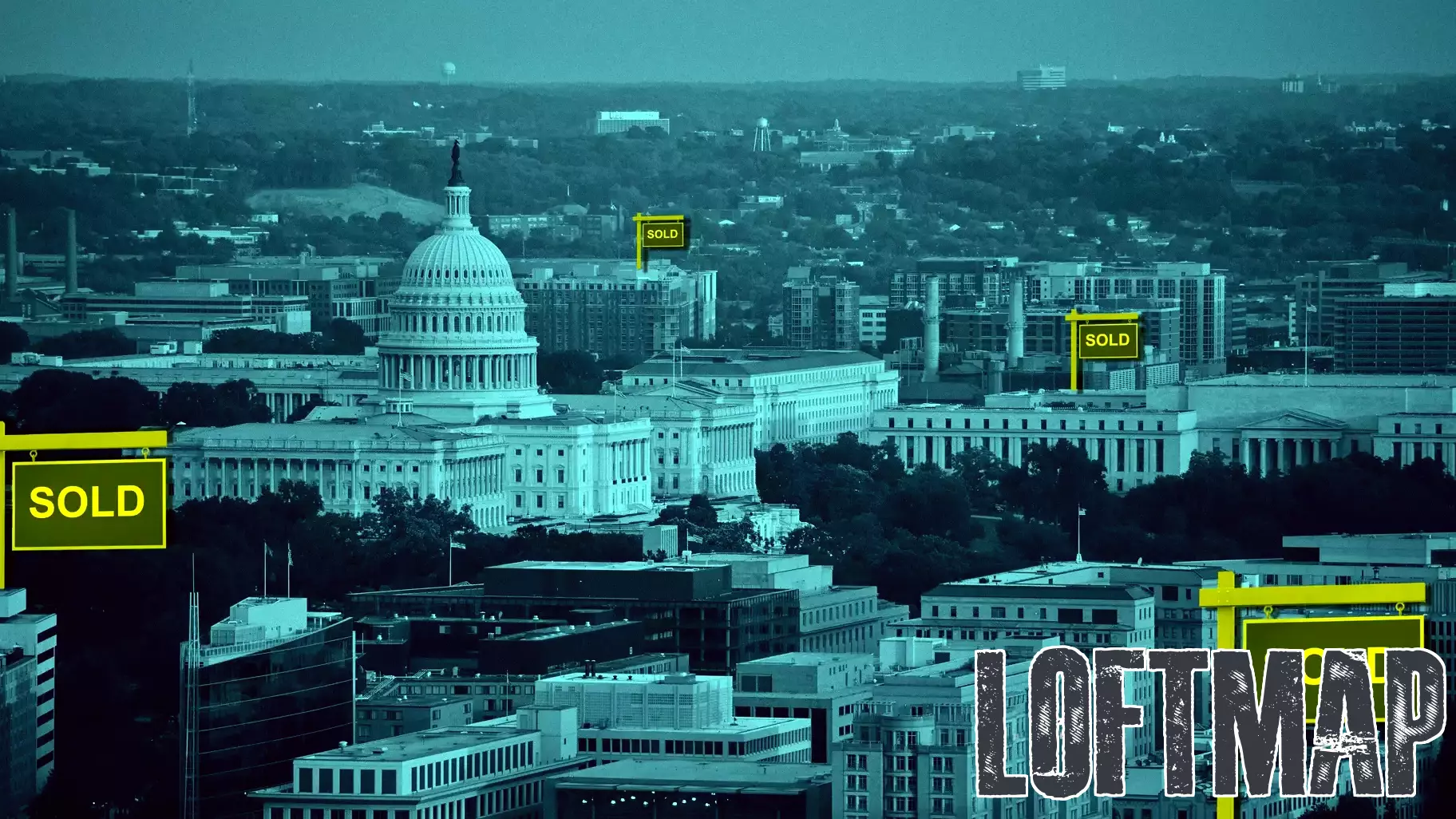

The federal government has recently sold 13 buildings, with claims from Elon Musk's DOGE that an additional 68 properties are currently available for sale. This significant move in the real estate sector could have far-reaching implications for the office real estate market.

As government agencies streamline operations and reduce their physical footprint, the influx of properties could lead to increased competition among buyers. This could drive down prices and alter investment strategies for commercial real estate developers. The availability of government buildings may also attract a diverse range of investors, from traditional real estate firms to tech startups looking for affordable office space.

Moreover, the potential repurposing of these buildings could reshape urban landscapes as new tenants bring innovative uses to these spaces. As the market adjusts to this wave of government property sales, stakeholders will need to closely monitor trends in occupancy rates and rental prices to navigate the evolving landscape of office real estate.